The cost of homes in London raised by 400% on average over the last 20 years, while the medium salary increased by 60%. As a consequence, while a home costs about 4 times the median average salary in 2000, the ratio of house price to earnings is now reaching 11 times the median annual salary in London [1].

Therefore, there is no surprise that in the last two decades home affordability has become a major concern of inequality and a marker of our society crisis. In order to address the issue, politicians have shown some degree of creativity in (re-)defining the concept of affordability.

The different categories of affordable home

Initially, there were only two simple concepts: social housing and market rent. As a way to show their determination to address the housing crisis, politicians added subcategories. Year after year they created new terms with differing definitions of affordability used for different purposes, including those provided in the London Plan.

Affordable rent was a concept set up by the Conservatives central government in 2011 (at that time Grant Shapps was Minister for Housing and Local Government). It was defined as a maximum of 80% of market rent and made available under similar criteria to social housing (households on the waiting list for social housing).

Nowadays, affordable rent covers so many different categories that even developers have difficulties to provide a simple answer when questioned on the level of affordable homes they will provide.

When he was Mayor of London, Boris Johnson introduced some granularity with a category “affordable homes capped” at 50% market rent, while the rest was described as “discounted affordable” (80% market rent).

After becoming Mayor in 2016, Sadiq Khan redefined the term of affordability with the concept of “Genuinely Affordable“. Later (confirmed in the London Plan 2021, page 183) the Mayor added to the confusion by defining London affordable Rent as “Genuinely affordable”, similar to social housing, while they are different categories [2]. On some documents published by City Hall [3], one can even find additional disarray with Intermediate Housing included into the category of Genuine Affordable.

In a nutshell, “genuinely affordable” is just a new way for saying “affordable”, maybe to differentiate from his predecessor schemes considered “not-really affordable”.

In the Mayor of London’s “new-speak“, genuinely affordable can be either Social rent, or London Affordable rent, and sometimes also Intermediate rent, although this category rent may be double the price of a social rent. Shared Ownership can be also called Intermediate which is also the London Living Rent but can differ from the Intermediate rent, although each category might be slightly different depending what document you read.

In the most recent documents (2021), we can grasp the complexity of the different categories of “affordability”, that we will classify arbitrarily between Affordable rent (25-65% market rent) and Intermediate (65-80% market rent).

Affordable rent

Social rent: This rent is the lowest range available, typically 25-50% of market rent prices in the local area. For 2022/23 the cap is £155.73/week for one-bedrooms and £164.87 for 2-bedrooms.

Social housing is provided by either housing associations (not-for-profit organisations that own, let, and manage rented housing) or the local council. This was used to be called Genuinely Affordable, a council term for traditional social housing and is currently the only category really affordable for individual on low incomes in London. Nowadays it is also called Fair rent.

NB: The Greater London Authority (GLA) has expressed a strong preference for lifetime tenancies for Social Rent homes [4] as a way to provide tenure security to residents of low cost rent housing. It was one of the first measures implemented by Wandsworth Labour after winning the elections in May 2022.

London Affordable Rent: This is an aspiration set up by Sadiq Kahn. There is no real cap, but it constitutes a guideline for the developers. The weekly rent benchmarks published by the GLA shows £168.34/week for one-bedrooms and £178.23 for 2-bedrooms which is about 8% above the social rent set out by the regulators.

Intermediate housing

This is defined as affordable housing which is targeted at people who have little chance of accessing low cost rent housing, but who are not able to afford to rent or buy a home on the open market. It can generally be set as rent between 65-80% market rent.

London Living Rent: With its Intermediate Housing Policy, the GLA is promoting London Living Rent (LLR) as a rent-to-buy product that supports access to homeownership. It helps private renters get onto the property ladder by buying part of their home with a low rent on the remaining.

LLR is available for those on household incomes below £60,000 per annum, who can afford to pay more than Social Rent but cannot afford to rent or buy open market housing.

Currently, all intermediate rented products such as London Living Rent and Discounted Market Rent should be affordable to households whose annual income is in the range £18,100–£66,000. For homes with more than two bedrooms, which are particularly suitable for families, the upper end of this eligibility range will be extended to £80,000.

London Shared Ownership: This is an intermediate ownership product very similar to the LLR but promoted by central government (with incentives and possibilities to defer stamp duty payments).

It allows households to buy on the open market, to purchase a share in a new home and pay a low rent on the remaining, unsold, share. It is available for households with up to £90,000 incomes (£80k outside London).

The minimum share for purchase is proposed to be set at 10% (previously 25%), with 90% being rent. You can buy up to a 75% share initially, and the rest at a later date, and in that case the dwelling will stop being considered in the affordable category).

This scheme is sometime described as a “scam” due to the many restrictions and pitfalls that buyers are often not aware of.

First homes: This scheme was set by central government in 2021 (and therefore there is no mention in the London Plan). They are property for sale discounted by a minimum of 30% against the market value, not higher than £420,000 in Greater London and reserved for first time buyers with annual household income not exceeding £90,000 in Greater London.

How the policy changed between 2015 and now

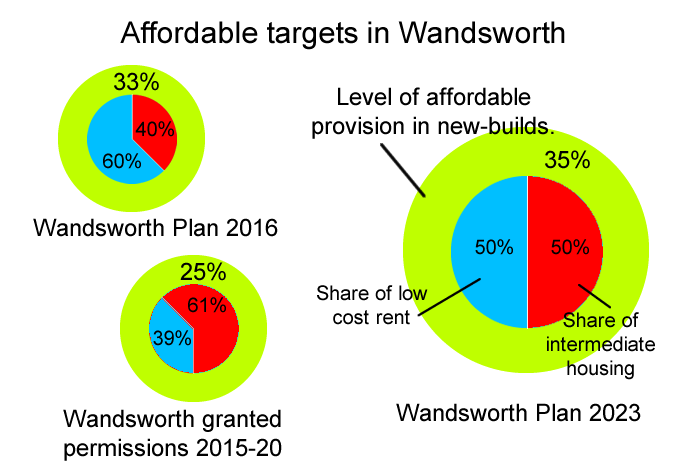

Ambitions seem to have lowered in the new versions of both the London and Wandsworth plans, but that could result in more realistic targets. While there is not much difference in terms of requirement for affordable homes ( about a third of new builds) the share of low-cost rented provision decreases in favour of other intermediate products.

London Plan targets in 2015 and 2021

London Plan 2015:

Affordable housing targets: Although there was no percentage under Boris Johnson leadership (Policy 3.12 of London Plan March 2015), the target was to deliver 17,000 affordable units per year between 2015 and 2025 (Policy 3.12 p 107 of London Plan March 2015).

In comparison to the overall provision of housing for London of 42,389 per year (Table 3.1 Annual average housing supply monitoring targets 2015 – 2025 p 89 of London Plan March 2015), it would have meant a target of 40% affordable homes in all new constructions.

The London plan specified that affordable units should be provided on site except on exceptional circumstances (Policy 3.12 p 107 of London Plan March 2015).

However, monitoring studies reported that it was a failure, with only half the planned affordable homes actually provided, going down from 24% to 20% of the share housing supply under Boris Johnson’s leadership.

Breakdown between social/affordable rented and intermediate housing: The affordable housing tenure should be provided as a split between 60% low-cost and 40% intermediate units.

- 60% of the affordable housing provision should be for social and affordable rent and

- 40% for intermediate rent or sale.

Priority should be accorded to provision of affordable family housing (Policy 3.11 of London Plan March 2015).

London Plan 2021:

Affordable housing targets: The strategic target is for 50 per cent of all new homes delivered across London to be genuinely affordable (Policy H4 page 172 of The London Plan 2021). However, a few pages later the plan explains that the threshold level of affordable housing is only a minimum of 35% when they are not public land or former industrial sites (Policy H5 Threshold approach to applications p 176).

Affordable housing should be provided on site. Affordable housing must only be provided off-site or as a cash in lieu contribution in exceptional circumstances.

NB par 4.5.3 p178: The London Plan explains that the percentage of affordable housing on a scheme should be measured in habitable rooms (any room used or intended to be used for sleeping, cooking, living or eating purposes. Enclosed spaces such as bath or toilet facilities, corridors, hallways, utility rooms or similar should not be considered habitable rooms). Only when this is not possible to compare similar rooms, applicants should use habitable floorspace (habitable room with a floor to ceiling height of 1.5m or over).

Breakdown between social/affordable rented and intermediate housing:

Under Sadiq Kahn, the criteria for split tenure is much looser that it was previously with a minimum of 30% low-cost dwellings, in comparison to 60% in the 2015 plan (Policy H6 – Affordable housing tenure p 181).

- A minimum of 30% low-cost rented homes (London Affordable Rent or Social Rent).

- A minimum of 30% intermediate products (London Living Rent and London Shared ownership).

- The remaining 40% to be determined by the borough as any type of affordable product (low-cost of intermediate).

Wandsworth Local Plan in 2016 and (proposed) 2023

Wandsworth Local Plan 2016:

Affordable housing targets:

Wandsworth Core Strategy Policy IS5 on Housing says (p122):

“On individual sites outside Nine Elms a proportion of at least 33% of homes should be affordable”

In Nine Elms, only 15% of affordable homes is required (Core Strategy 2016 4.188 p117). It is worth noting that in the absence of a specific target in the 2015 London Plan, Wandsworth had the possibility to set a number below the aspiration of the London Plan.

Breakdown between social/affordable rented and intermediate housing:

Wandsworth Core Strategy Policy IS5 on Housing says:

“On new developments a mix of intermediate (40%) and social/affordable rented (60%) accommodation will be sought. Significant levels of family accommodation will be sought in appropriate locations.”

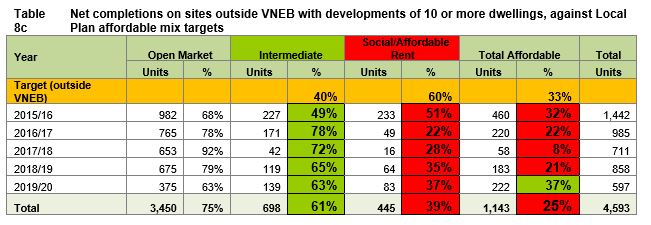

However, while setting their split tenure targets, the document displays contradictory target on page 118 (table 4.7) , with figures showing 53% Intermediate and 47% Social/Affordable, and even nearly the exact opposite for the period 2015/16 to 2019/20: 38% social/affordable rent and 62% intermediate overall (Table 4.7 Affordable housing targets by tenure p 118 of Core Strategy 2015)

Wandsworth Local Plan (submission) 2023:

Affordable housing targets:

Policy LP23 Affordable Housing (page 346) does not specify any figure but instead says that “sites must provide affordable housing on-site in accordance with the threshold approach set out in London Plan Policy H5“. It means that they will seek a minimum of 35% when they are not public land or former industrial sites and 50% otherwise.

Breakdown between social/affordable rented and intermediate housing:

Policy LP23 Affordable Housing page 346 says

“The Council will require an affordable housing tenure split of 50% low-cost rent products,

25% First Homes and 25% other intermediate productsand a balance of other intermediate products.” [5]

In accordance to the London Plan, it says that affordable housing will be required on site. Off-site provision of affordable housing will only be accepted in exceptional circumstances

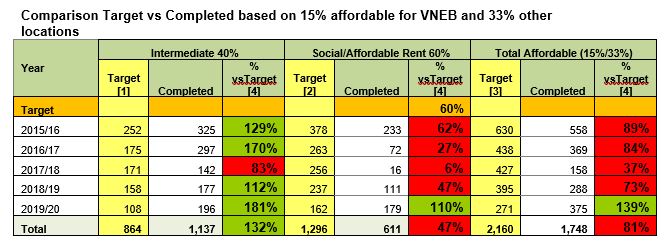

Between 2015 and 2020, Wandsworth missed its overall target of Social/Affordable Rent units in all years except one (and every single year if we exclude VNEB) as shown in the table below.

While the housing crisis has exacerbated in London, both the new London Plan and Wandsworth Local plan seem to set new goals that are below the previous targets. On the other hand, with no real intention to enforce the targets, previous numbers have been constantly missed.

As the proverb says: “When there is a will, there is a way“, the future will demonstrate if the new targets have more values than the one printed in previous plans.

[1] 1998: Average property in London = £104,000 and median full-time annual salary in London = £25,000

2018: Average property in London = £477,000 and median full-time annual salary in London = £40,000

[2] The 2021 London Plan defines the affordable housing tenures in its policy H6, page 181.

[3] In Intermediate housing: The evidence base August 2020 we can read page 3: “The new London Plan sets out a requirement for a minimum of 30% of affordable housing to be delivered as intermediate homes which meet the Mayor’s definition of genuinely affordable.”

[4] Additional information are available in Homes for Londoners: Affordable Homes Programme 2021-2026: Equality Impact Assessment, from page 12.

Update 18/01/2022:

[5] In a last minute change on 27th October 2022 (2 weeks before the official Local Plan examination), the Council submitted an amendment proposing to remove the mention of First homes in the Housing policy LP23 and instead use “a balance of other intermediate products“. [Schedule of Main Modifications suggested by the Council, WBC-010, PPMM/091 and PPMM/092 with changes in the supporting text at PPMM/093.]

In the past, last minute changes have been a reason for the Inspector to reject Wandsworth Local Plan.