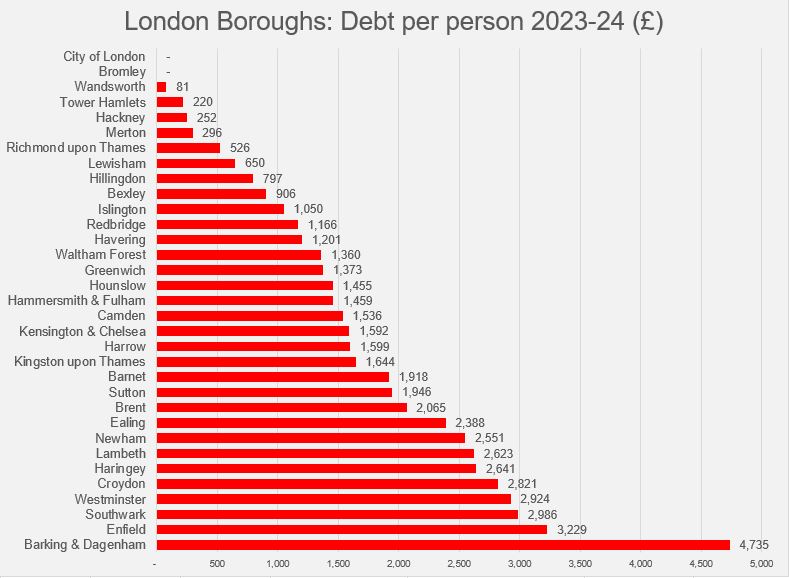

A recent BBC analysis revealed that UK councils collectively carry a staggering debt of £97.8 billion, equating to an average debt of £1,455 per resident as of September 2023. Woking unfortunately leads the pack when considering the level of borrowing per inhabitant, with an enormous debt nearing £2 billion and a population just over 100,000. Although Birmingham holds the record for the largest total debt among all local authorities, standing at nearly £3 billion, its population is more than ten times that of Woking (1,142,000 residents), resulting in a lower debt per person. However, Birmingham’s financial situation is so concerning, as it has issued a section 114 notice, restricting spending to essentials and often referred to as “effective bankruptcy.”

Woking’s debt per person is alarmingly high at nearly £19,000, while 38 local authorities (10% of the total) have no borrowing at all. Wandsworth, with its consistent communication from Wandsworth Conservatives about low council tax and excellent financial management, is unsurprisingly among the nearly-debt-free councils. Currently, the debt per resident in Wandsworth is only £81!

Building on the BBC’s analysis, Clapham Junction Insider has extended the analysis and compared also the changes over the last decade. In this article, we will particularly focus on the London boroughs but you can find all the data and the methodology used at the bottom of this article.

Within London, The City of London and Bromley are the only London councils without debt.

The City of London, known as the “Square Mile” and concentrate financial institutions, is unique in the country as this is not a council. It has its own governance structure and is separated from the Greater London Authority. We have included it in our charts in addition to the 32 boroughs forming the GLA as this is a part of London, but due to its size and population (about 8600 residents) it is considered a specific case.

Thus, the only London council outperforming Wandsworth is Bromley, being entirely debt-free. Without any surprise for Wandsworth residents who remember the frequent comparisons of council tax between Wandsworth and Lambeth, Bromley Conservatives leverage this argument against their Labour-majority neighbour, Croydon.

**OFFICIAL**

🌳Bromley's Conservative-run Council is officially debt-free.

💷This is opposed to Labour-run Croydon Council, which is £1.6 BILLION in debt.

📆Each year, £300 from EVERY household's Council Tax goes towards paying the interest on this huge debt. pic.twitter.com/tpXLJ3Z0lX

— Croydon Conservatives ☝️🇬🇧 (@CroydonTories) May 3, 2022

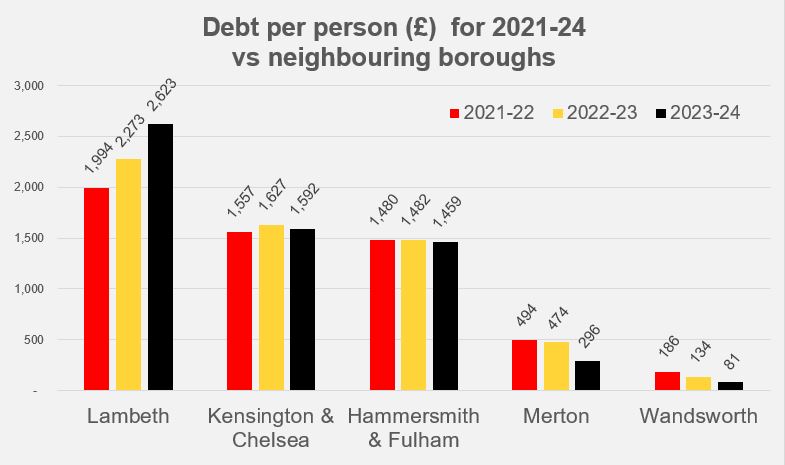

However, correlating council tax or debt levels with management quality is a precarious argument. It is very easy to point out some Conservatives led councils with a high level of debt per resident, such as Kensington and Chelsea with £1592, while Hackney which has been controlled by Labour for most of the period since 1964 maintains a very low debt.

The BBC explained that some local councils have taken out significant loans due to factors like reduced spending power and an aging population, while facing a reduction in central government income.

In addition, some councils face substantial debt from a 2012 legislation change (signed by then Communities secretary Eric Pickles) enabling them to acquire social housing stock and use loan money for commercial investments aimed at generating income, leading to accusations of gambling with public funds. The critical concern is whether indebted councils can service these debts while maintaining essential services, with the Guardian even predicting that one in five council leaders in England are likely to declare bankruptcy in the next 15 months.

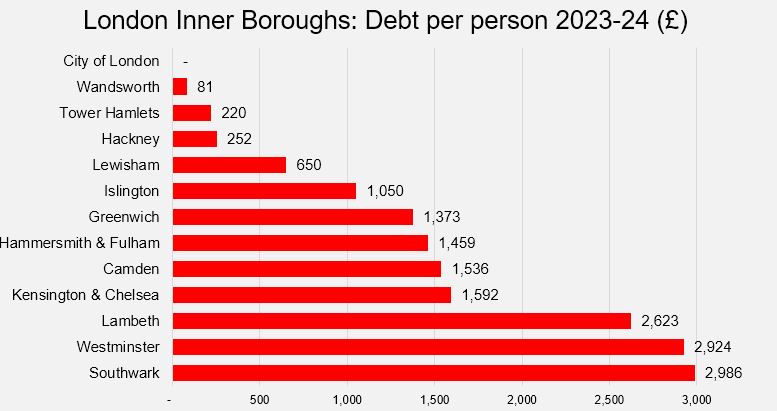

If we compare with other London inner boroughs only, then Wandsworth is crowned winner with the lowest debt per resident (as we saw earlier, the City of London is a specific case and not a GLA Council).

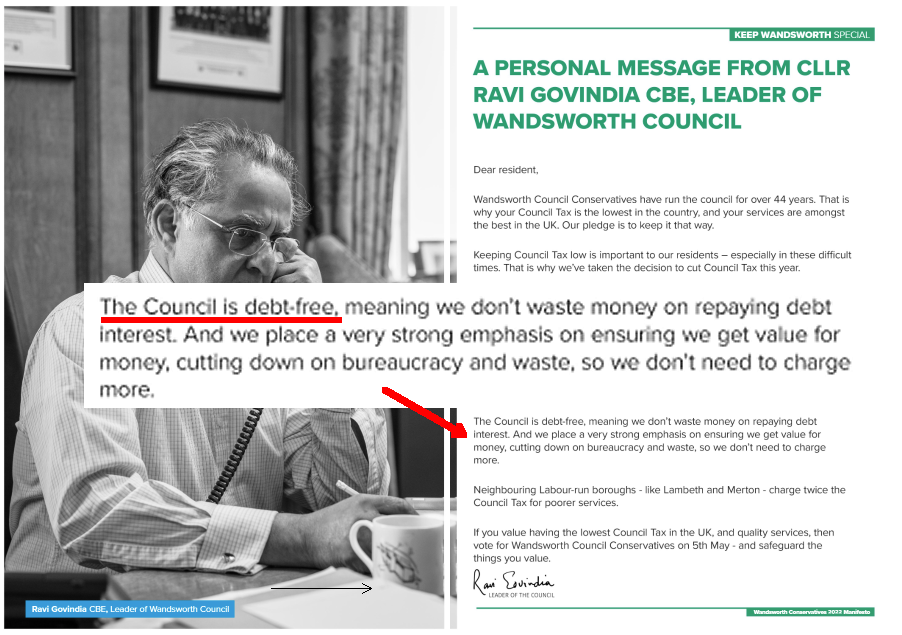

Some people might have been puzzled to even see some debt for Wandsworth, given the assertions made during the recent local elections about the Council’s substantial general savings. The Wandsworth Conservatives’ manifesto published in April 2022 displayed a personal message from the leader of the Council claiming that the Council was debt-free.

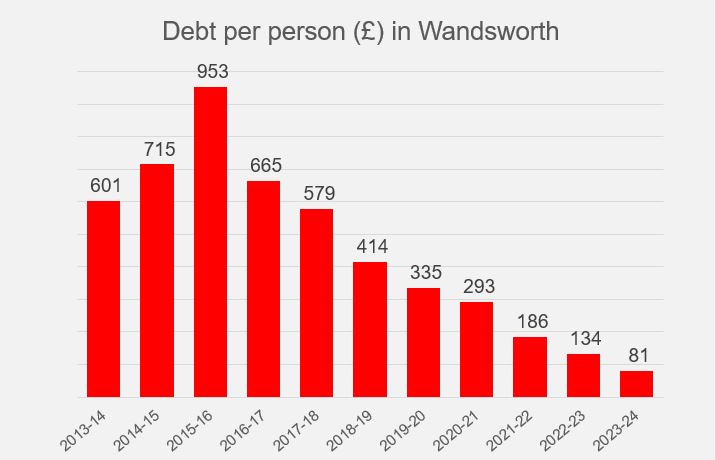

In reality, Wandsworth borough has always displayed some level of borrowing – albeit low – over the last decade that we have studied. It fluctuated to reach a maximum of £953 per resident in 2016-17 (with a debt of £197,023,000) to £81 (corresponding to a total of £26,498,000) nowadays.

One explanation lies in distinct funding that are safeguarded and cannot be used out of their restricted allocations, therefore making borrowing necessary to fund some projects. Councillor Aydin Dikerdem, cabinet member in charge of housing, explained that part of the social housing build program must be funded by borrowing:

“There is a legal separation between the housing revenue account and general funds and they cannot cross-subsidy each other. Currently, while interest rates are high, we are doing some internal borrowing from the cash reserves, but we cannot do that indefinitely. Therefore, we are also taking loans on the housing revenue account that we pay back from that same account”

Wandsworth’s financial situation remains among the healthiest in the country, surpassing Lambeth, Kensington and Chelsea, Hammersmith, and even Merton, which also maintains a low level of debt per resident.

- Read our article: Property developers are cash cows for Wandsworth

While the BBC predicts a deficit of £116.73 per person in 2023/24, Wandsworth’s finances appear robust. The new Labour administration should find sufficient flexibility for the transformations they intend to implement.

METHODOLOGY:

In order to present the figures, we have entirely followed the method chosen by the BBC. You can check the BBC data here.

We extracted debt data from the borrowing and investment live tables (Q2 2023 to 2024) by the Department for Levelling Up, Housing and Communities. The spreadsheet contains all the data since 2014 for outstanding borrowing by local authority.

We followed the same guidance as expressed by the BBC (guidance they received from the Borrowing Statistics Data Collection Team), and we have summed all the categories except Short Term Loans Local Authorities and Long Term Loans Local Authorities in order to avoid double-counting.

Population figures are published by the Office for National Statistics (ONS) (‘Dataset Estimates of the population for the UK, England, Wales, Scotland and Northern Ireland’, Mid-2019: April 2020 local authority district codes edition of this dataset which contains all series from 2001 to 2019, completed with Mid-2020 edition of this dataset and Mid-2021 edition of this dataset for the following years).

We have chosen to follow the same methodology as the BBC to have consistent figures, which means that we have used the 2021 population to compare with the 2023-24 borrowing figures. We also used the 2021 population against the 2022-23 borrowing data but for all previous years we used the population data from the previous year, for example the 2020 population for the 2021-22 borrowing data, the 2019 population for the 2020-21 borrowing data, etc.

For more information about the methodology and especially the complexity of measuring debt against core spending power and its problems, you can refer to the explanations given by the BBC.